How a flexible, pre-tax benefit plan will slash

your organization's tax bill and reduce your employee's medical and dependent care costs by 35%!

**Hint: It is explained in Sec. 125 of the U.S. tax code**

If you want to rescue your company and its employees from much of today's payroll and income

tax burden compliments of the IRS, a pre-tax benefit plan is for you. Every American Company needs to take advantage of a

pre-tax benefit plan because of the tax savings it generates for both the company and its employees.

Although flexible, pre-tax (cafeteria) benefit plans have been approved by the IRS since

1978, they have just scratched the surface in smaller organizations. If you are a small business manager and still

do not have a pre-tax benefit plan option in your business or non-profit organization, you are throwing away cash and you

risk losing your best employees!

A flexible, pre-tax

benefit plan, sometimes called a cafeteria benefit plan, can reduce your organization's payroll taxes (FICA and Workmen's

Compensation), reduce benefit administration costs, and provide world-class income and FICA tax savings for your employees.

With the right tools and knowledge you can out-perform the big banks and insurance

companies as a benefit-plan administrator. You can spare your company thousands of dollars in benefit plan administration

fees and even generate a sizable year-in and year-out income for yourself by administering a flexible spending plan for others,

if you are so inclined!

Tax experts encourage companies large and

small to set up flexible medical spending accounts, dependent care reimbursement accounts, and tax-deferred 401(k) savings

accounts. Doing so can save thousands of payroll tax dollars per year for the company, and will slash income and payroll taxes

paid by their employees at the same time. This increase in takehome pay can help offset today's rising healthcare costs.

A flexible-spending plan is a "win-win" situation for the organization

and its employees, and is an absolutely required "perk" in today's competitive employment environment.

Employee-oriented companies are always on the lookout for ways to improve fringe

benefits and employee take-home compensation. Profit-oriented companies are cost-conscious and concerned with productivity

and efficiency in their operations. At this web site you will find the information to let you achieve both objectives!

With the FREE information here, your business or non-profit organization,

whatever its size, can improve employee benefits, increase employee's take-home pay, reduce payroll tax expenditures,

and reduce employee-benefit administration costs starting immediately!

We are committed to providing you with all of the information, support, and tools you need to establish a smooth-running

and cost-effective FSA plan in your company.

Even though

the big benefit plan administrators would like you to believe that the process of setting up and administering a flexible

spending plan is complicated, it is actually very easy with the right information - and the information you need is FREE.

(Just read on!) And it is all done with almost no effort or book keeping once it is set up correctly - and we'll

show you how!

So what makes us experts in flexible

spending plans?

We have been advising, setting up, and administering

cafeteria benefit plans since 1987. Thousands of companies have downloaded our free, customizable summary plan descriptions

to get jump started with their own improved, pre-tax benefit plans. Our FAST-FLEX PLUS software administration tool is used

to do the bookkeeping grunt work for thousands of flex plan participants at hundreds of companies all over the U.S.

We know what works and we know all the time and effort-saving tricks.

We started out writing PC-based software for flexible spending account administration.

This software enabled companies of all sizes to set up and administer their own flexible spending accounts. Some of the nation's

largest accounting firms, banks, corporations, and benefit administrators have purchased our software over the years.

Maybe even more importantly, some of the nation's smallest businesses rely on

our software and information services to compete on equal footing with the big boys when it comes to offering modern employee

benefits.

By working closely with our customers for over a decade,

we have continuously improved our flexible spending account services and software. FAST-FLEX PLUS can interface with virtually

any payroll system, reimburse qualified expenses according to your pay interval, and handle any combination of flexible spending

accounts.

FAST-FLEX PLUS includes the plan legal documents,

participant enrollment forms, software, and training for self-administration of flexible spending plans.

Timely, responsive service builds employee Flexible Spending Account participation

levels. This leads to more payroll tax savings for your company. Your own company, not some distant and expensive administrator

is in the best position to make certain that your plan is the best it can be.

If you have a small business or work for one, you should not let another day pass without setting up your own flexible

spending plan!

Let's look at the tax-saving potential

for a typical employee and a small company as automatically calculated by FAST-FLEX PLUS:

| Cafeteria Plan Paycheck Comparison |

Employee: John Q. Doe State: Utah Marital Status: M Exemptions Claimed: 5 |

| ** Amounts shown are per SEMI-MONTHLY pay Period** |

| | Before "Flex" | After "Flex" |

| Income and Benefits | | |

| Wages and Salary | $2083.33 | $2083.33 |

| Company-paid

Benefits | 750.00 | 750.00 |

| Total Compensation | $2833.33 | $2833.33 |

| | | |

| Deductions for paycheck calculation | | |

| Company-paid

benefits | $750.00 | $750.00 |

| Federal Tax 1/ | 145.00 | 136.00 |

| State Tax 2/ | 85.00 | 81.00 |

| FICA

3/ | 159.37 | 154.95 |

| Misc. Deductions | 50.00 | 50.00 |

| Medical

Expenses | 0.00 | 17.50 |

| Disability Insurance Premium | 0.00 | 2.80 |

| Health Ins. Premium | 20.00 | 20.00 |

| Total Deductions | $1226.88 | $1229.75 |

| | | |

| Initial Paycheck | $1606.46 | $1603.58 |

| Benefit Purchases | 20.30 | 20.30 |

| Flex

Plan Reimbursement | 0.00 | 20.30 |

| Final Take-home Pay | $1586.16 | $1603.58 |

| Total Tax Savings 4/ | $0.00 | $17.42 |

Footnotes: 1/ Federal tax and FICA amounts calculated using the percentage withholding method. 2/ State tax withholding computed from tables. 3/

Full FICA withholding occurs during 12.0 months. 4/ Tax savings of $17.42

per pay period equates to annual tax savings of $418.12 per year. Tax savings estimate has been reduced by $0.00 dependent

care credit. |

| Annual Company Tax Savings with a Flexible Spending

Plan |

| Average Deferral per Employee

below FICA Base | $2500.00 |

| FICA Tax Rate | 7.65% |

| No. Employees below FICA Wage Base | 35 |

| Total FICA

Tax Savings | $6694.00 |

| | |

| Average Deferral per

Employee below Medicare Base | $3300.00 |

| Medicare

Tax Rate | 1.45% |

| No. Employees below Medicare Wage Base | 5 |

| Total Medicare Tax Savings | $239.00 |

| | |

| Average Deferral per Employee below Umemploy. Base | $2100.00 |

| Unemployment Insurance Tax Rate | 4.00% |

| No. Employees below Unemployment Wage Base | 10 |

| Total Unemployment Tax Savings | $840.00 |

| | |

| Annual Tax Savings to Company | $7773.00 |

| Estimated annual Administration Fee | $1800.00 |

| | |

| Net Annual Tax Savings to Company | $5973.00 |

Please note: These are tax savings that repeat payday after payday, year-after-year. There is no reason to put off

moving forward with your own flex plan another day!

Anybody

can do accounting for flexible spending accounts in their organization with our coaching! The basic mechanics of flexible

spending plan administration business are very simple and work like this:

1.

Present a summary plan description to your company and employees. The summary plan description provides an overview of how

a flexible-spending plan works. Supplement this with educational materials for the employer and all employees. A free Summary

Plan Description is here.

2. Enroll the interested employees into

the flexible-spending plan. The employee designates how much he would like withheld from each paycheck to cover out-of-pocket

medical and dependent care expenses. (These should be conservatively estimated since the law requires that these pre-tax funds

must be used within the plan fiscal year.)

3. Compute the total company

payroll tax savings. Generally, these payroll savings more than offset any administration fees the company will pay you, meaning

the program is almost always free to the employer!

4. Set aside the

employee's designated withholding amount each payday. These funds are typically set aside into a flexible spending plan

bank account by the company's payroll department..

5. Request reimbursements.

As employees incur qualified medical and dependent care expenses, they mail or fax the receipt to the flexible spending plan

administrator and request a reimbursement. Once a week, or however often you decide in conjunction with the employees, FAST-FLEX

PLUS prints reimbursement checks on either your own check stock or the company's.

That's about all there is to it! Once a year, a form 5500 must be filed with the Department of Labor to insure

the plan does not favor highly compensated employees. Do not to worry about the filing requirements! FAST-FLEX

PLUS makes end-of year filing a breeze, or if you prefer, our team of experienced legal experts will file your forms for you!

Why you need the best software tools

The software

tools you need to administer a cafeteria benefit plan are not expensive. In fact, a FREE, no-obligation Summary Plan Description

legal document that you can customize to meet your organization's needs is available to you within seconds. (Click here!)

But these flex plan administration

tools must be designed from the ground up to automate the entire process: from employee enrollment to payroll system interface

to expense reimbursement to reporting.

Good flexible spending

plan administration software is essential if you are to do a professional job of reimbursing your co-worker's qualified

expenditures and do it profitably with minimal time commitment.

Without

the best software tools to automate the administration process, the time and money you spend will eat away your tax savings.

You might even risk having your flex plan disqualified by the IRS!

While

there is no need to overpay for an industrial strength software system to administer flexible spending accounts, there is

too much at risk to try homemade software built with a spreadsheet program. Likewise, you should avoid systems that are hard

to install, that are hard to learn, and that charge you so much upfront and for support that they will eat all of your tax

savings and then some!

Why doesn't every company

and non-profit organization already have a flexible spending plan for their employees?

The main reason that more companies do not administer their own flexible spending accounts is due to all of the setup,

recording, reporting, and check printing chores they fear are associated with "flex" plan administration. But not

to worry! FAST-FLEX PLUS contains all of the educational materials you will need for the employer, employee, and the plan

administrator to get a flexible spending plan up and running quickly in any organization.

Now is the time to improve your employee benefits, start saving tax dollars, and stop wasting

benefit plan administration fees.

Recent surveys indicate

that only a small fraction of America's employees work at companies that offer flexible spending accounts in spite of

the fact that these IRS-approved programs have existed since 1978.

Employees

consistently rate comprehensive benefit programs as a key reason for accepting employment at one firm over another, so you

want your benefit programs to be state-of-the-art in today's employment marketplace.

But even when a flexible spending plan is offered, many workers fail to fully participate in cafeteria plans because

the tax-saving benefits of these plans haven't been adequately demonstrated. Uninformed employees soon become an expense

as a result of frequent turnover. You will be provided with all the information and tools you need to remedy this potential

disaster!

Serve your clients year 'round and

increase your cash flow!

If you own (or plan to start) an accounting,

tax preparation, insurance, or other consulting service, you are in the perfect position to add benefit plan administration

to your list of services offered. Using FAST-FLEX PLUS is an easy way to stay in constant contact with your clients,

save them tax dollars throughout the year, and gain a year-round return from your consulting practice!

Some of your client companies will already have a flexible spending account plans, but their

employees and even the company itself may have become disenchanted by poor service from their current plan administrators.

Many plan administrators actually put the burden of bookkeeping on the plan participants!

By using FAST-FLEX PLUS to automate the entire administration process, the potential market for flex

plan administration is almost unlimited! You can offer a service that every one of the 20 million companies and 135 million

employees in America deserves!

"... Great program!

We administer several plans with different pay periods and many employees. FAST-FLEX PLUS keeps track of it all!

- Lori DeMeta, EMCOR, Inc., Orem, UT

Using the cafeteria plan templates

and FAST-FLEX PLUS software we supply, you simply offer the administration service to your company or clients to

help them realize major tax and benefit plan administration savings quickly. FAST-FLEX PLUS easily handles all of

the setup, recording, reporting, and check-printing chores associated with "flex" plan administration

If you choose to become a third-party benefit plan administrator, you can

begin collecting $3.00 to $7.00 per participating employee each month!

The "going rate" that benefit plan administrators charge is $1.00 per employee per month for "premium-only"

(POP) plans. POP plans mean that the employee-paid portion of health and life insurance premiums are deducted from their paycheck

on a pre-tax basis.

If the employee elects to also have out-of-pocket

medical and dependent care costs deducted from his paycheck on a pre-tax basis, administrators typically charge $4.00 to $7.00

per employee per month. For every 1,000 participants in the plans you administer, your income is $4,000 to $7,000 per month!

Remember, there is no limit to the number of employees and companies you

can administer with one copy of FAST-FLEX PLUS!

To

make life even easier, FAST-FLEX PLUS can be installed on your network so that multiple operators can enter data,

look up account balances, and print reports for any employee in any company - all at the same time!

With FAST-FLEX PLUS, your administration time and expenses are minimal. Experience

has shown that one full-time data-entry person can handle more than 5,000 flexible spending plan participants. No computer

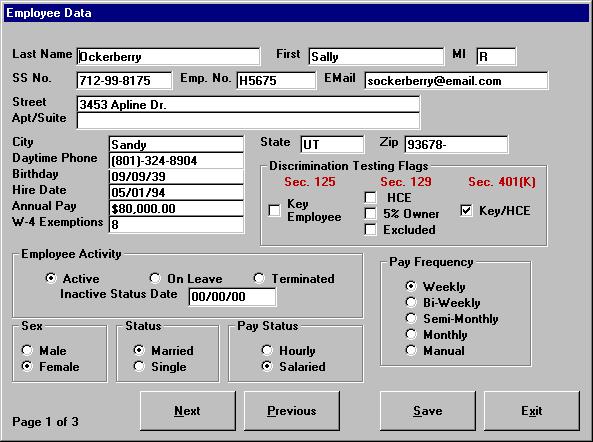

or accounting experience is required! Below is a screen shot of the plan participant data-entry form:

Postage costs to mail reimbursement checks directly to employees

can be included in the administration fees you charge their employer, or reimbursement checks can be returned in bulk to the

company for in-house distribution.

As a flexible benefit plan administrator,

you can make thousands of dollars by using our software only a few hours a week. What other software do you use that not only

saves you time, but literally puts money in your wallet every time you use it? FAST-FLEX PLUS is a complete, do-it-yourself

software-based solution for flexible benefit plan implementation and administration.

With today's increasingly diversified work force, employers can't afford to offer a "one-size-fits-all"

benefits package.

Employers will either pay for benefits

an employee doesn't need or risk losing valuable employees whose needs aren't adequately met. Flexible benefit plans

are the answer to this dilemma and are truly a win-win-win proposition for you, employees, and your company.

We frequently ask ourselves why every business and non-profit organization in America

doesn't already have a flexible spending account plan for its employees. Flexible spending account plans have been around

for many years . Virtually every personnel department knows how "Flex" plans work and realizes that they truly are

a "no-brainer" deal for both employees and the company.

From

our experience, there are three main reasons why companies have hesitated to start administering their own plan:

1) Time. Companies are too busy to deal with yet another administrative

task.

2) Cost. Third-party flex-plan administrators

typically do a poor job for the fees they charge.

3) Trust.

Businesses are rightfully nervous about sending large sums of money to an unaffiliated third party for repayment back to its

employees.

These three problems persist with most flexible spending

plans. The problems can usually be traced to:

Poor software.

Most flex plan administrators actually put the burden of tracking medical and dependent care costs back onto the employee.

How do they do this? With limitations like these: "You may only send in accumulated reimbursement requests that total

more than $50." Or, "Only twelve requests per year may be submitted, no more than once per month."

By contrast, the FSA plans administered in-house with FAST-FLEX PLUS allow

employees to send in a request for reimbursement as soon as they have the receipt in hand. The company designates how often

requests for reimbursement are paid. The employee is relieved of any bookkeeping chores and receives his reimbursement money

faster. Below is an example of all it takes to print reimbursement checks for every participant who has an outstanding request

for a qualified reimbursement expenditure:

Poor Account Information. Other administrators

only send out year-end or quarterly account balance statements to the employees and company. By contrast, all FAST-FLEX

PLUS reimbursement check stubs show current account balance and year-to-date expenditure totals. It also prints detailed

quarterly statements and provides complete audit and account reconciliation reports that can be run at any time. Employees

can call for up-to-the-minute account balance information. Account balance reports can be sent to plan participants by e-mail

or published to the company Intranet.

Poor Control

Over Withheld Funds. FAST-FLEX PLUS offers several options to handle the transfer of funds from your company's

payroll withholdings to the individual employee reimbursement accounts and then back to employees as qualified expenses are

incurred. This provides the company with enhanced control over its employee benefit funds.

The plain truth is, our software beats every other alternative for flexible benefit plan administration,

regardless of how outrageously the others are priced!

Before

explaining some of the many features of FAST-FLEX PLUS, let me try to put the value of this software in perspective.

Clumsy, mainframe-adapted competing products typically go for $5,000 to $20,000,

but even at our affordably low price, you'll have everything you need to easily and successfully administer

an unlimited number of cafeteria benefit plans on your PC.

Besides

that, our web-based marketing approach means that we don't have to feed an expensive marketing staff that "hound-dogs"

you into buying. You won't have to hire a third-party system integrator to install it and you won't need to pay for

days of training either. Our incredibly comprehensive, easy-to-learn, and incredibly low priced FAST-FLEX PLUS does

the marketing for us.

With our package, you can meet employee

benefit needs, increase each employee's take-home pay compliments of the IRS, and reduce any company's payroll taxes

and administration fees - with minimal time and effort!

"...

I have personally been using your software for four years and have always found your support team to be most helpful. Our

accounting department loves the audit trail your software provides. The various summary reports in the software have been

a real timesaver." - Judy C. Goodwin, Builder Marts of America, Greenville, SC

FAST-FLEX PLUS Software - Partial list of features:

·State-of-the-art, 32-bit Windows source code for greater data capacity and

faster operation.

·Full debit-card integration makes reimbursement

instantaneous and convenient. Account balances are always available on-line.

·Handles unlimited companies, divisions, and employees. We have a version to fit your organization.

·Imports employee names, addresses, etc., from almost any payroll or HR software. Saves

hours of initial data entry.

·On-line, context-sensitive help

gets you up to speed quickly.

·Comprehensive, on-the-fly, non-discrimination

testing. No more bad end-of-year surprises!

·Generates HTML

year-to-date statements that you can post to the internet or send via e-mail so that plan participants always know their account

balances!

·Automatically checks for duplicate flexible spending

plan reimbursement requests.

·Handles up to ten flexible spending

or insurance accounts and (optionally) up to eight 401k-investment choices for each participating employee. The software has

the capacity to grow with your business and changes in IRS laws.

·Built-in

report generator provides a variety of management and employee reports at the click of a mouse button. Reports can be sent

to screen, disk file, or printer. Time saving reporting features are built-in. No need to fire up the word processor or spreadsheet.

·Export data, reports, or account balances to any word processor or spreadsheet.

(OK. So you want to build your own customized reports. Have it your way!)

·Prints

flexible spending account reimbursement checks automatically. Uses your own blank check stock. Also, can export to Quicken,

Versacheck, or Direct-Deposit software in *.QIF format so that you can use them to print your reimbursement checks if you

choose!

·Operates on any partial or fiscal year. You can start

administering your benefit plan today!

·Automatically updates

(posts) or imports paycheck benefit deductions to eliminate manual data entry.

·Menu driven. Requires no special accounting or computer knowledge.

·Self contained. No need to buy or learn another spreadsheet, database, or other software package.

·Applicable to all types of businesses - both profit and non-profit.

·Works with any printer.

·Complete

bank reconciliation and audit trail.

·Client-server network

ready. No limit on simultaneous users. (Also works great on a stand-alone PC!)

·FAST-FLEX PLUS comes with a complete, no-questions-asked, 90-day free trial. Use it and abuse it

before you are ever asked to pay a penny. You just can't loose!

Will FAST-FLEX PLUS work for your company? You bet! We have loyal users in all kinds of businesses including

banks, non-profit social work, churches, life insurance agencies, CPA firms, temporary personnel agencies, and retail establishments.

All are excited about the instant expertise and time and money savings FAST-FLEX PLUS has given to them:

"... Our company provides many personnel related services to the East Coast.

We only have time for the best and most suitable software, and when we run into a problem, we need immediate attention. I

would like to extend my gratitude to Interval Software's support team. They have always gone the extra mile for me. I

find the software to be very easy to learn and overall one of the best programs I have! I give it two thumbs up!" - Angie

Ciatardini, American Manpower Technologies, Roanoke, VA

If you want

a flexible spending account up and running in your organization within 24 hours, click here to download Fast-Flex Plus right now!

If you would like to speak with one of our representatives, call our office

at (801) 544-2314. Please, before you call, list your questions on paper as our staff is very, very busy (we are all working

crazy amounts of overtime to improve our products and market them effectively) and we want to be as efficient as possible

in answering your questions.

E-mail is an even more convenient way to contact us. We make a sincere effort to answer every

e-mail within 24 hours!

And if you still have questions, there is

an excellent chance that we have them covered on our FAQ and self-help web pages.

Your Guarantee:

FAST-FLEX PLUS Pays For Itself Within 90 Days Or It Costs You Nothing!

That's right. You have 90 days to use FAST-FLEX PLUS and convince yourself that it's the best way

ever to slash taxes for your business and your employees. If FAST-FLEX PLUS doesn't pay for itself within 90

days, just stop using it! You will not be billed and you will owe us nothing! You won't even have to ship anything back

because FAST-FLEX PLUS is delivered digitally.

And, no matter

what you decide, the FREE Summary Plan Description is yours to keep!

So please

don't hesitate. Every day wasted results in lost tax and administration fee dollars that should be going into your pocket!